Exchange Platforms for Altcoin Trading

- Understanding Altcoins and Their Role in the Cryptocurrency Market

- The Rise of Altcoin Trading and Its Impact on the Crypto Industry

- Exploring the Benefits of Using Exchange Platforms for Altcoin Trading

- A Comparison of Popular Exchange Platforms for Altcoin Trading

- Tips for Choosing the Right Exchange Platform for Altcoin Trading

- The Future of Altcoin Trading: Trends and Predictions

Understanding Altcoins and Their Role in the Cryptocurrency Market

Altcoins play a significant role in the cryptocurrency market, offering investors a diverse range of options beyond the well-known Bitcoin. These alternative coins provide unique features and functionalities that cater to specific needs and preferences of traders.

Understanding altcoins is essential for anyone looking to diversify their cryptocurrency portfolio. While Bitcoin remains the dominant player, altcoins have gained popularity due to their potential for higher returns and innovative technologies.

Altcoins can serve various purposes, such as facilitating smart contracts, enhancing privacy and security, or improving scalability. Each altcoin has its own set of characteristics and use cases, making it crucial for traders to research and analyze them before investing.

Exchange platforms play a vital role in enabling the trading of altcoins. These platforms provide a marketplace where buyers and sellers can exchange different cryptocurrencies, including altcoins. By using exchange platforms, traders can access a wide range of altcoins and take advantage of price fluctuations in the market.

The Rise of Altcoin Trading and Its Impact on the Crypto Industry

The rise of alternative coin (altcoin) trading has had a significant impact on the cryptocurrency industry. As more and more investors look for opportunities beyond Bitcoin and Ethereum, altcoins have gained popularity for their potential for high returns. This trend has led to the emergence of numerous altcoin exchange platforms, catering to the growing demand for trading these digital assets.

Altcoin trading offers investors a diverse range of options to diversify their portfolios and capitalize on emerging trends in the crypto market. With thousands of altcoins available for trading, investors can choose from a variety of projects with unique value propositions and potential for growth. This diversity in altcoin offerings has contributed to the overall expansion and maturation of the cryptocurrency market.

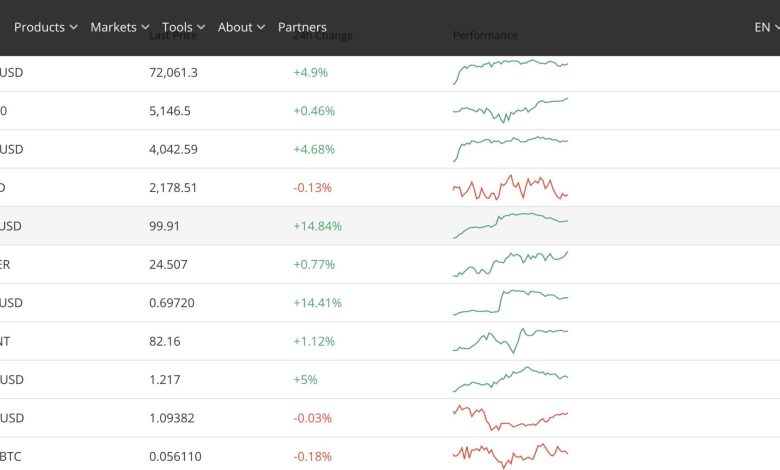

Exchange platforms for altcoin trading play a crucial role in facilitating the buying and selling of these digital assets. These platforms provide a secure and efficient marketplace for investors to trade altcoins, offering features such as advanced charting tools, real-time market data, and order matching algorithms. By providing a seamless trading experience, these platforms have helped fuel the growth of altcoin trading and attract a broader audience of investors.

Exploring the Benefits of Using Exchange Platforms for Altcoin Trading

Exploring the advantages of utilizing exchange platforms for altcoin trading can provide numerous benefits for investors looking to diversify their cryptocurrency portfolio. These platforms offer a wide range of altcoins to choose from, allowing traders to explore new investment opportunities beyond the popular cryptocurrencies like Bitcoin and Ethereum.

One of the key benefits of using exchange platforms for altcoin trading is the ability to access a larger pool of liquidity. This can result in faster trade execution and potentially better prices for altcoins. Additionally, these platforms often offer advanced trading features such as margin trading and stop-loss orders, which can help traders manage risk more effectively.

Furthermore, exchange platforms typically provide a secure environment for trading altcoins, with robust security measures in place to protect users’ funds and personal information. This can give investors peace of mind knowing that their assets are safe from potential cyber threats.

Overall, exploring the benefits of using exchange platforms for altcoin trading can open up new opportunities for investors to diversify their cryptocurrency holdings and potentially generate higher returns. By taking advantage of the features and liquidity offered by these platforms, traders can navigate the altcoin market with confidence and efficiency.

A Comparison of Popular Exchange Platforms for Altcoin Trading

When it comes to trading altcoins, there are several popular exchange platforms that traders can choose from. Each platform has its own unique features and benefits, making it important for traders to compare them before deciding which one to use. Here is a comparison of some of the most popular exchange platforms for altcoin trading:

1. Binance: Binance is one of the largest and most well-known cryptocurrency exchanges in the world. It offers a wide range of altcoins for trading, low fees, and a user-friendly interface. Binance also has a mobile app, making it convenient for traders to buy and sell altcoins on the go.

2. Coinbase Pro: Coinbase Pro is the advanced trading platform offered by Coinbase, one of the most popular cryptocurrency exchanges for beginners. While Coinbase Pro has a smaller selection of altcoins compared to Binance, it is known for its high level of security and regulatory compliance.

3. Kraken: Kraken is another popular exchange platform that offers a wide range of altcoins for trading. Kraken is known for its strong security measures, low fees, and high liquidity. It also offers advanced trading features for experienced traders.

4. Bittrex: Bittrex is a US-based exchange platform that offers a large selection of altcoins for trading. Bittrex is known for its fast trade execution, high security standards, and user-friendly interface. It is a popular choice among traders looking to diversify their altcoin portfolio.

5. Huobi: Huobi is a Singapore-based exchange platform that offers a wide range of altcoins for trading. Huobi is known for its high liquidity, low fees, and advanced trading features. It also has a strong presence in the Asian market, making it a popular choice for traders in that region.

In conclusion, when choosing an exchange platform for altcoin trading, it is important to consider factors such as the selection of altcoins available, fees, security measures, and user experience. By comparing the features of different exchange platforms, traders can find the one that best suits their trading needs and preferences.

Tips for Choosing the Right Exchange Platform for Altcoin Trading

When it comes to choosing the right exchange platform for altcoin trading, there are several factors to consider to ensure a smooth and successful trading experience. Here are some tips to help you make an informed decision:

- **Security:** Look for an exchange platform that prioritizes security measures such as two-factor authentication, cold storage for funds, and regular security audits.

- **Liquidity:** Opt for a platform with high liquidity to ensure that you can easily buy and sell altcoins without significant price slippage.

- **Fees:** Compare the fees charged by different exchange platforms, including trading fees, deposit and withdrawal fees, and any other hidden costs.

- **User Interface:** Choose a platform with a user-friendly interface that makes it easy to navigate the trading process and access essential information.

- **Customer Support:** Consider the quality of customer support offered by the exchange platform, including response times and availability of support channels.

By taking these factors into account, you can select an exchange platform that meets your needs and preferences for altcoin trading. Remember to conduct thorough research and read reviews from other traders to make an informed decision.

The Future of Altcoin Trading: Trends and Predictions

The future of altcoin trading is filled with exciting trends and predictions that are shaping the landscape of exchange platforms. As the cryptocurrency market continues to evolve, it is essential for traders to stay informed about the latest developments in order to make informed decisions.

One of the key trends in altcoin trading is the rise of decentralized exchanges (DEXs). These platforms allow users to trade directly with one another without the need for a central authority. This not only increases security and privacy but also reduces the risk of hacking and fraud.

Another trend to watch out for is the increasing popularity of algorithmic trading. This automated approach to trading uses algorithms to execute trades at high speeds, taking advantage of market fluctuations. As technology continues to advance, we can expect to see more sophisticated trading strategies being employed.

Furthermore, the integration of artificial intelligence (AI) and machine learning into altcoin trading is expected to revolutionize the way trades are conducted. These technologies can analyze vast amounts of data in real-time, providing traders with valuable insights and predictive analytics.

Overall, the future of altcoin trading is bright and full of potential. By staying informed about the latest trends and predictions, traders can position themselves for success in this dynamic and rapidly changing market.