Future Applications of Blockchain in Finance

- Introduction to Blockchain Technology

- Current Applications of Blockchain in Finance

- Benefits of Implementing Blockchain in Financial Services

- Challenges and Limitations of Blockchain in Finance

- Emerging Trends in Blockchain Technology for Financial Institutions

- Regulatory Considerations for Blockchain Adoption in the Finance Industry

Introduction to Blockchain Technology

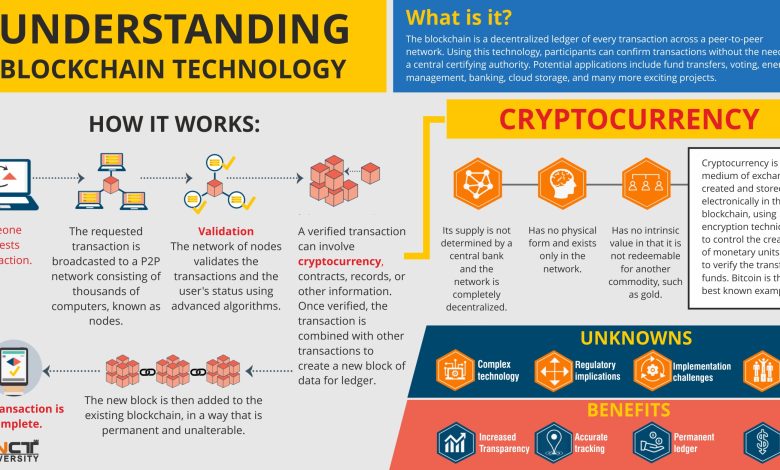

Blockchain technology is a revolutionary innovation that has the potential to transform various industries, including finance. It is a decentralized and distributed ledger system that securely records transactions across a network of computers. This technology ensures transparency, security, and immutability of data, making it an ideal solution for financial applications.

One of the key features of blockchain technology is its ability to create trust among parties without the need for intermediaries. This can significantly reduce transaction costs and processing times in the financial sector. Additionally, blockchain technology enables real-time settlement of transactions, eliminating the need for lengthy clearing processes.

Furthermore, blockchain technology can enhance the security of financial transactions by encrypting data and providing a tamper-proof record of all transactions. This can help prevent fraud and unauthorized access to sensitive information. Additionally, blockchain technology can improve the efficiency of compliance processes by providing a transparent and auditable record of all transactions.

Overall, blockchain technology has the potential to revolutionize the finance industry by increasing transparency, reducing costs, and improving security. As more financial institutions adopt this technology, we can expect to see a wide range of innovative applications that will streamline processes and enhance the overall customer experience.

Current Applications of Blockchain in Finance

Blockchain technology has already made significant strides in the finance sector, with various applications being implemented to streamline processes and enhance security. Some of the current applications of blockchain in finance include:

- Payment and money transfers: Blockchain technology has been utilized to facilitate faster and more secure cross-border payments and money transfers. This has significantly reduced transaction costs and processing times.

- Smart contracts: Smart contracts are self-executing contracts with the terms of the agreement directly written into code. Blockchain technology enables the automation of these contracts, reducing the need for intermediaries and increasing efficiency.

- Identity verification: Blockchain technology can be used for secure and decentralized identity verification, reducing the risk of identity theft and fraud.

- Trade finance: Blockchain technology has the potential to revolutionize trade finance by providing a transparent and secure platform for tracking and verifying transactions.

- Asset tokenization: Blockchain technology allows for the tokenization of assets, making it easier to trade and transfer ownership of assets such as real estate or art.

These are just a few examples of how blockchain technology is currently being used in the finance sector. As the technology continues to evolve, we can expect to see even more innovative applications that will further transform the way financial transactions are conducted.

Benefits of Implementing Blockchain in Financial Services

Implementing blockchain technology in financial services offers a wide range of benefits that can revolutionize the industry. Some of the key advantages include:

- Enhanced Security: Blockchain provides a secure and tamper-proof way of storing and transferring data, reducing the risk of fraud and unauthorized access.

- Increased Transparency: The decentralized nature of blockchain ensures that all transactions are recorded on a public ledger, promoting transparency and accountability.

- Cost Efficiency: By eliminating intermediaries and streamlining processes, blockchain can help reduce costs associated with traditional financial transactions.

- Improved Speed: Transactions on a blockchain network can be processed much faster than traditional methods, leading to quicker settlements and improved efficiency.

- Enhanced Traceability: Every transaction on a blockchain is recorded and timestamped, allowing for easy traceability and auditability of financial activities.

Overall, the implementation of blockchain in financial services can lead to a more secure, transparent, and efficient system that benefits both businesses and consumers alike.

Challenges and Limitations of Blockchain in Finance

There are several challenges and limitations that need to be considered when discussing the future applications of blockchain in finance. While blockchain technology offers many benefits, it is not without its drawbacks.

- Scalability: One of the main challenges facing blockchain in finance is scalability. As the number of transactions increases, the network can become congested, leading to slower transaction times and higher fees.

- Regulatory uncertainty: The regulatory environment surrounding blockchain and cryptocurrencies is still evolving. This uncertainty can make it difficult for financial institutions to fully embrace blockchain technology.

- Security concerns: While blockchain is often touted as being secure, there have been instances of hacks and security breaches in the past. Ensuring the security of financial transactions is crucial for widespread adoption.

- Interoperability: Different blockchain platforms may not be compatible with each other, making it challenging to transfer assets between different networks. This lack of interoperability can hinder the seamless integration of blockchain in finance.

- Cost: Implementing blockchain technology can be costly, especially for smaller financial institutions. The initial investment required to adopt blockchain may be a barrier for some organizations.

Despite these challenges and limitations, the potential for blockchain in finance is vast. By addressing these issues and finding solutions, the financial industry can unlock the full benefits of blockchain technology.

Emerging Trends in Blockchain Technology for Financial Institutions

Blockchain technology is revolutionizing the financial industry, offering numerous benefits to financial institutions. There are several emerging trends in blockchain technology that are shaping the future of finance:

- Increased Security: Blockchain provides a secure and tamper-proof way of storing data, reducing the risk of fraud and cyber attacks.

- Efficiency Gains: By automating processes and reducing the need for intermediaries, blockchain technology can streamline operations and reduce costs for financial institutions.

- Improved Transparency: The decentralized nature of blockchain allows for greater transparency in transactions, making it easier to track and verify financial activities.

- Smart Contracts: Smart contracts are self-executing contracts with the terms of the agreement directly written into code. This can automate complex processes and reduce the need for manual intervention.

- Tokenization of Assets: Blockchain technology enables the tokenization of assets, allowing for the fractional ownership of assets and making them more liquid.

Financial institutions are increasingly exploring the potential of blockchain technology to transform their operations and provide better services to their customers. By embracing these emerging trends, financial institutions can stay ahead of the curve and remain competitive in the rapidly evolving financial landscape.

Regulatory Considerations for Blockchain Adoption in the Finance Industry

When considering the adoption of blockchain technology in the finance industry, it is crucial to take into account the regulatory landscape that governs this sector. Regulations play a significant role in shaping how blockchain can be utilized within financial institutions, as they provide guidelines and standards for compliance and security.

One of the key regulatory considerations for blockchain adoption in finance is the need for clear guidelines on data privacy and security. Financial institutions must ensure that they are compliant with data protection regulations such as GDPR, which govern the collection, storage, and processing of personal data. Blockchain technology can help enhance data security by providing a tamper-proof and transparent ledger, but it is essential to ensure that it aligns with existing privacy laws.

Another important regulatory consideration is the need for clarity on smart contracts and digital assets. Smart contracts, which are self-executing contracts with the terms of the agreement directly written into code, raise questions about legal enforceability and liability. Regulators need to provide guidance on how smart contracts will be recognized under the law and how digital assets will be treated within existing regulatory frameworks.

Additionally, regulatory bodies must address concerns around anti-money laundering (AML) and know your customer (KYC) requirements in the context of blockchain adoption. While blockchain technology can enhance transparency and traceability, it also presents challenges in verifying the identity of transacting parties and monitoring for suspicious activities. Regulators need to work with industry stakeholders to develop solutions that balance the benefits of blockchain with the need to prevent financial crimes.