Predicting the Next Bull Run

- Understanding market trends and indicators

- Analyzing historical data for insights

- Identifying potential catalysts for a bull run

- Expert opinions on the current market conditions

- Strategies for maximizing gains during a bull run

- Risks to consider when predicting the next bull market

Understanding market trends and indicators

Understanding market trends and indicators is crucial when trying to predict the next bull run in the financial markets. By analyzing various factors such as price movements, trading volume, and investor sentiment, traders can gain valuable insights into the direction of the market.

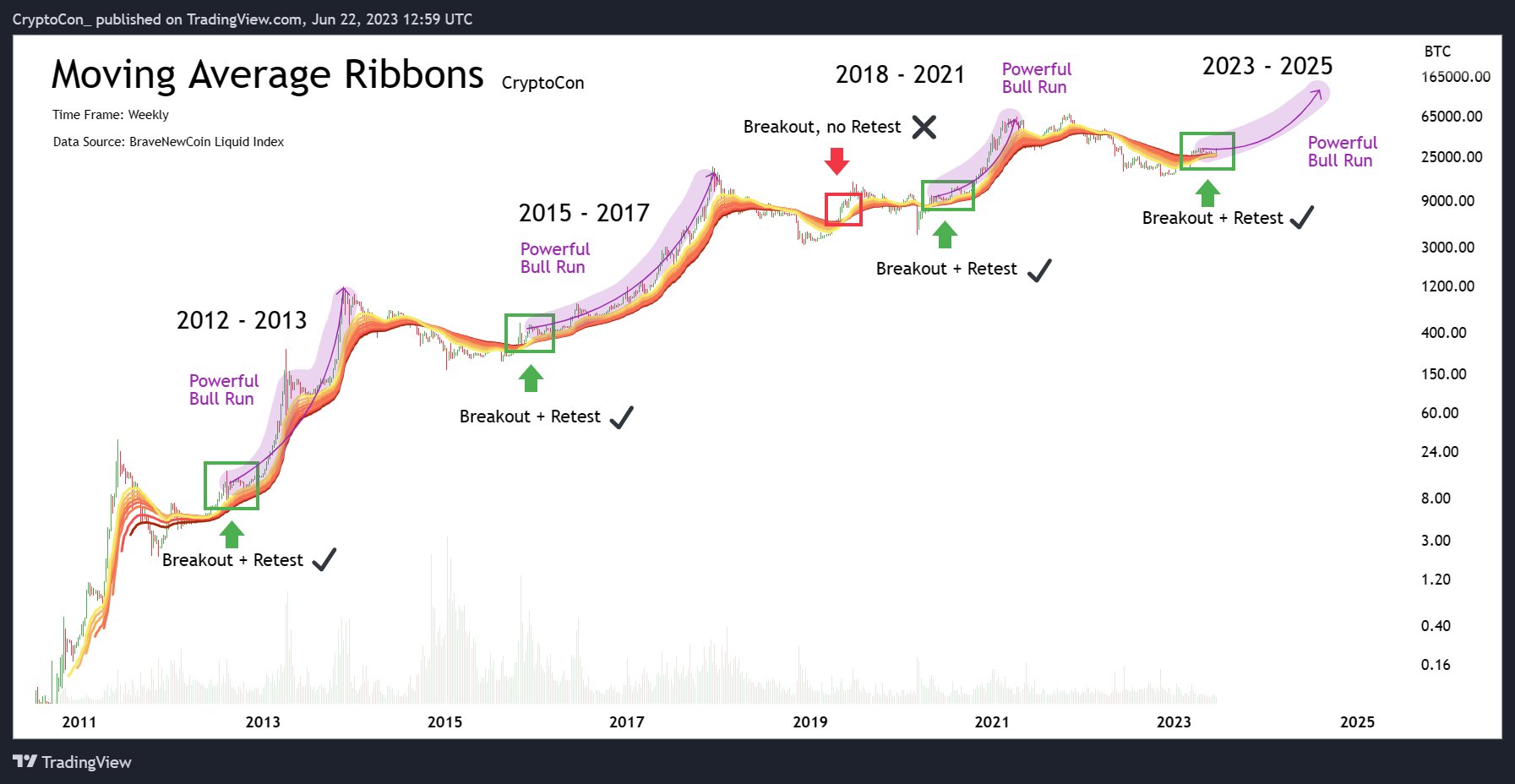

One key indicator to watch is the moving average, which helps smooth out price data to identify trends over time. When the price of an asset is above its moving average, it is generally considered a bullish signal, indicating that the market is likely to continue rising. Conversely, when the price is below the moving average, it may signal a bearish trend.

Another important indicator to consider is the Relative Strength Index (RSI), which measures the speed and change of price movements. An RSI above 70 typically indicates that an asset is overbought and may be due for a correction, while an RSI below 30 suggests that it is oversold and could be poised for a rebound.

Additionally, keeping an eye on market sentiment through tools like the Fear and Greed Index can provide valuable insights into investor psychology. Extreme fear or greed in the market can often signal a potential reversal in the trend, as markets tend to move in cycles of fear and euphoria.

By combining these various market trends and indicators, traders can better position themselves to anticipate and capitalize on the next bull run in the financial markets. It is essential to stay informed and adapt to changing market conditions to make informed decisions and maximize profits.

Analyzing historical data for insights

One way to gain insights into predicting the next bull run is by analyzing historical data. By looking at past trends and patterns in the market, we can identify potential indicators that may signal when a bull run is likely to occur. This analysis can help us make more informed decisions when it comes to investing in the market.

When analyzing historical data, it is important to consider various factors such as market conditions, trading volume, and price movements. By examining these data points, we can start to identify correlations and trends that may help us predict future market behavior. This can be especially useful for identifying potential entry and exit points for trades.

Additionally, historical data analysis can also help us understand the underlying factors that have contributed to past bull runs. By studying the events and news that coincided with previous market surges, we can gain a better understanding of the market dynamics and sentiment that drove those movements. This knowledge can be valuable in predicting when similar conditions may arise in the future.

Overall, analyzing historical data for insights can provide valuable information that can help us make more informed decisions when it comes to predicting the next bull run. By leveraging this data, we can better position ourselves to capitalize on potential market opportunities and navigate the ups and downs of the market with more confidence.

Identifying potential catalysts for a bull run

Identifying potential catalysts for a bull run can be a crucial aspect of predicting the next market upswing. There are several key factors that investors and analysts often look at to determine what might trigger a bull run in the near future. One potential catalyst could be positive economic data, such as strong job growth or increasing consumer spending. Another factor to consider is central bank policies, as decisions to lower interest rates or implement quantitative easing measures can often stimulate market activity.

Additionally, geopolitical events can also play a significant role in sparking a bull run. For example, a resolution to a trade dispute between major economies or the signing of a significant trade agreement can boost investor confidence and lead to a surge in market activity. Technological advancements and breakthroughs in key industries can also act as catalysts for a bull run, as they can create new opportunities for growth and innovation.

Overall, keeping a close eye on these potential catalysts can help investors stay ahead of the curve and position themselves to take advantage of a bull run when it occurs. By analyzing these factors and staying informed about market trends, investors can make more informed decisions about when to enter or exit the market to maximize their returns.

Expert opinions on the current market conditions

Experts have varying opinions on the current market conditions and the possibility of a bull run in the near future. Some analysts believe that the market is showing signs of recovery and that a bullish trend may be on the horizon. Others, however, are more cautious and point to potential risks and uncertainties that could hinder a sustained uptrend.

One school of thought suggests that the recent market volatility is a temporary setback and that the underlying fundamentals remain strong. These experts argue that factors such as low interest rates, government stimulus packages, and improving economic indicators could fuel a bull market in the coming months. They advise investors to stay optimistic and look for buying opportunities in undervalued assets.

On the other hand, some analysts are concerned about the potential impact of geopolitical tensions, inflationary pressures, and regulatory changes on the market. They warn that these factors could dampen investor sentiment and lead to increased volatility in the short term. As a result, they recommend a more cautious approach and suggest diversifying portfolios to mitigate risks.

Overall, while there is no consensus among experts on the timing and extent of the next bull run, it is clear that market participants should stay informed and be prepared for all possible scenarios. By staying vigilant and adapting to changing market conditions, investors can position themselves to capitalize on opportunities and navigate potential challenges in the ever-evolving financial landscape.

Strategies for maximizing gains during a bull run

During a bull run, it is crucial to have strategies in place to maximize gains and take full advantage of the market momentum. Here are some tips to help you make the most of a bull run:

- Diversify your portfolio: One of the most important strategies during a bull market is to diversify your investments. By spreading your capital across different assets, you can reduce risk and increase your chances of profit.

- Stay informed: Keep a close eye on the market trends and news that could impact the market. By staying informed, you can make more informed decisions about when to buy or sell assets.

- Set realistic goals: It is essential to set realistic goals for your investments during a bull run. By having clear objectives, you can stay focused and avoid making impulsive decisions.

- Take profits: Don’t be afraid to take profits during a bull market. It is essential to lock in gains and not get greedy, as the market can change quickly.

- Use stop-loss orders: To protect your investments during a bull run, consider using stop-loss orders. These orders can help you limit your losses if the market suddenly turns bearish.

By following these strategies, you can position yourself to maximize gains and navigate the market successfully during a bull run.

Risks to consider when predicting the next bull market

When trying to predict the next bull market, it is important to consider the risks involved. While it can be tempting to focus solely on the potential gains, it is crucial to also take into account the potential downsides. Some of the risks to consider include:

- Market Volatility: The stock market can be highly volatile, with prices fluctuating rapidly. This can make it difficult to accurately predict when a bull market will occur.

- External Factors: Economic events, political instability, and global crises can all impact the stock market and potentially derail a bull market.

- Overvaluation: If stocks are overvalued, it could lead to a market correction rather than a sustained bull run.

- Timing: Timing the market is notoriously difficult, and even the most experienced investors can struggle to predict when a bull market will begin.

- Black Swan Events: Unforeseen events, such as natural disasters or terrorist attacks, can have a significant impact on the stock market and disrupt any predictions of a bull market.

By carefully considering these risks, investors can make more informed decisions when trying to predict the next bull market. It is important to approach market predictions with caution and to be prepared for any potential challenges that may arise.