The Economics of NFTs: Supply and Demand

- Understanding the Basics of NFTs

- Exploring the Digital Art Market

- The Role of Blockchain Technology in NFTs

- Factors Influencing the Value of NFTs

- Challenges and Opportunities in the NFT Market

- Future Trends in NFT Economics

Understanding the Basics of NFTs

NFTs, or non-fungible tokens, have gained significant popularity in recent years as a new form of digital asset. Understanding the basics of NFTs is crucial for anyone looking to participate in this emerging market.

NFTs are unique digital tokens that represent ownership of a specific item or piece of content. Unlike cryptocurrencies such as Bitcoin or Ethereum, which are fungible and can be exchanged on a one-to-one basis, NFTs are one-of-a-kind and cannot be replicated. This uniqueness is what gives NFTs their underlying value and appeal to collectors and investors alike.

One key aspect of NFTs is their ability to be bought, sold, and traded on various online marketplaces. These marketplaces provide a platform for creators to mint and sell their NFTs, while buyers can purchase them using cryptocurrency. The supply of NFTs is determined by the number of tokens minted by creators, while the demand is driven by collectors and investors seeking to acquire these unique digital assets.

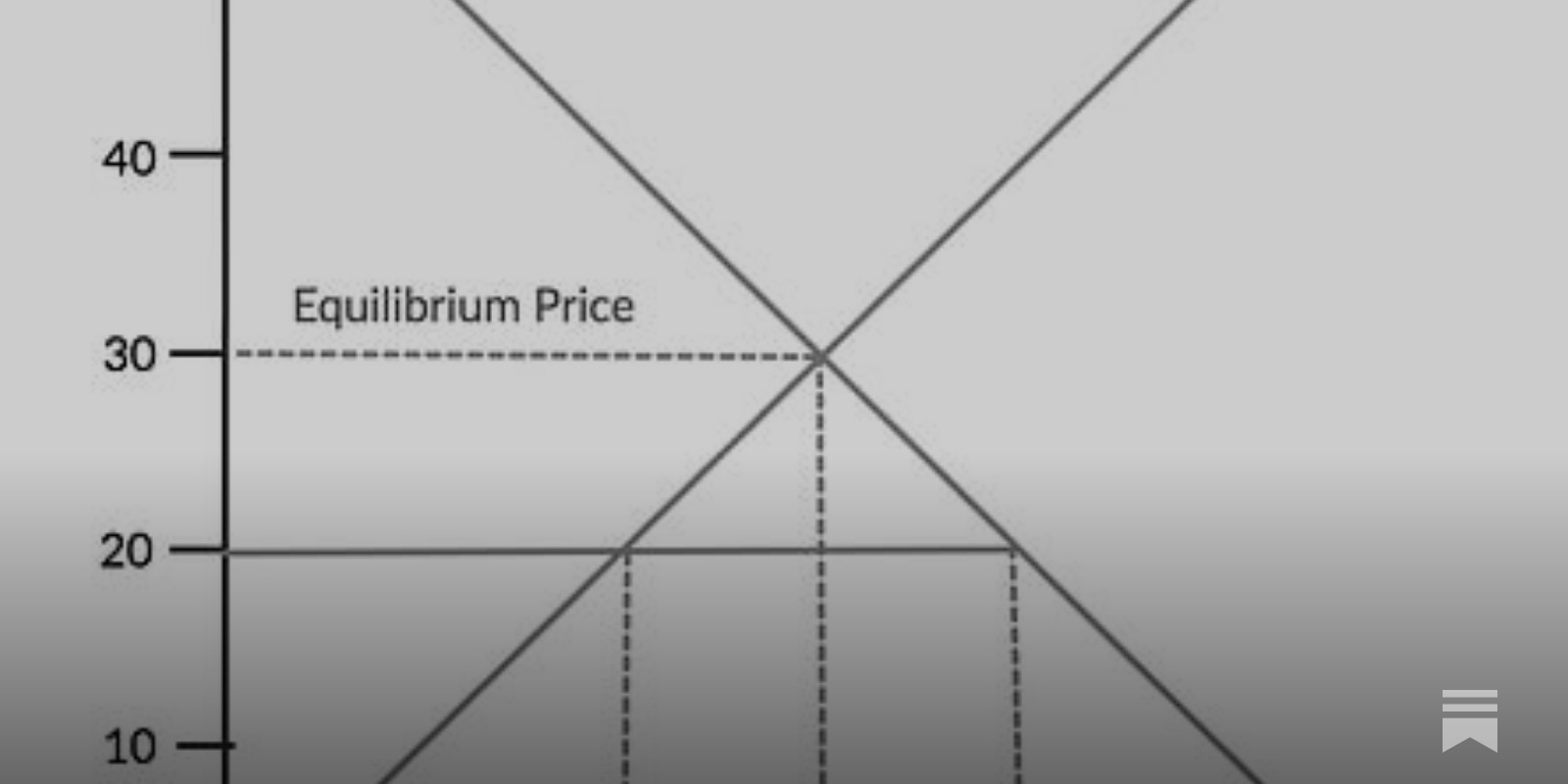

As with any market, the economics of NFTs are influenced by supply and demand dynamics. When the supply of a particular NFT is limited, and the demand is high, the value of that NFT is likely to increase. Conversely, if the supply outweighs the demand, the value of the NFT may decrease. This balance between supply and demand is what ultimately determines the price of an NFT in the marketplace.

In conclusion, understanding the basics of NFTs is essential for navigating this rapidly evolving market. By grasping the concept of non-fungible tokens, their unique properties, and the supply and demand dynamics that drive their value, individuals can make informed decisions when buying, selling, or investing in NFTs.

Exploring the Digital Art Market

The digital art market has seen a significant surge in popularity with the rise of NFTs. Non-fungible tokens have revolutionized the way art is bought and sold, creating a new digital economy for artists and collectors alike. As the demand for NFTs continues to grow, so does the supply of digital art available on various platforms.

Exploring the digital art market reveals a dynamic landscape where artists can showcase their work to a global audience without the need for traditional galleries or intermediaries. This direct connection between creators and buyers has democratized the art world, allowing for greater accessibility and transparency in transactions.

One of the key factors driving the economics of NFTs is the concept of scarcity. Each NFT is unique and cannot be replicated, making it a valuable digital asset for collectors. This scarcity, combined with the growing demand for digital art, has led to a surge in prices for NFTs across different platforms.

As more artists and collectors enter the digital art market, the supply and demand dynamics continue to evolve. Artists are exploring new ways to monetize their work through NFTs, while collectors are seeking out unique pieces to add to their digital collections. This constant flux in the market creates opportunities for both creators and buyers to participate in this exciting new economy.

The Role of Blockchain Technology in NFTs

Blockchain technology plays a crucial role in the world of NFTs, providing a secure and transparent platform for buying, selling, and trading digital assets. By utilizing blockchain, NFTs are able to be uniquely identified and authenticated, ensuring their scarcity and provenance. This technology also enables smart contracts to be embedded within NFTs, allowing for automatic royalty payments to creators each time their NFT is sold.

Furthermore, blockchain technology ensures that NFT transactions are recorded on a decentralized ledger, making them immutable and resistant to fraud or tampering. This level of security and trust is essential in the NFT market, where high-value digital assets are exchanged. Additionally, blockchain technology allows for the fractional ownership of NFTs, opening up new possibilities for investors and collectors alike.

Overall, the integration of blockchain technology into the world of NFTs has revolutionized the way digital assets are bought, sold, and owned. Its decentralized nature, security features, and smart contract capabilities have made it an indispensable tool for creators, collectors, and investors in the burgeoning NFT market. As the demand for NFTs continues to grow, blockchain technology will undoubtedly play an increasingly important role in shaping the economics of this unique and exciting market.

Factors Influencing the Value of NFTs

Several factors can influence the value of non-fungible tokens (NFTs) in the market. Understanding these factors is crucial for both buyers and sellers in the NFT space. Some of the key factors influencing the value of NFTs include:

- Rarity: The rarity of an NFT can significantly impact its value. NFTs that are one-of-a-kind or part of a limited collection tend to be more valuable due to their scarcity.

- Artist Reputation: The reputation and popularity of the artist behind an NFT can also play a role in determining its value. Established artists with a strong following are likely to command higher prices for their NFTs.

- Historical Sales: Previous sales data of similar NFTs can provide insights into the potential value of a new NFT. High prices in past sales can indicate strong demand and influence future pricing.

- Utility: The utility or functionality of an NFT can impact its value. NFTs that offer additional benefits or access to exclusive content may be more valuable to collectors.

- Market Trends: Like any other asset, NFT values can be influenced by market trends and investor sentiment. Keeping an eye on market dynamics and trends can help buyers and sellers make informed decisions.

By considering these factors and staying informed about the NFT market, participants can better navigate the complexities of buying and selling NFTs. Ultimately, understanding the supply and demand dynamics of NFTs is essential for maximizing value in this rapidly evolving digital asset class.

Challenges and Opportunities in the NFT Market

The NFT market presents both challenges and opportunities for investors and creators alike. Understanding these dynamics is crucial for navigating this rapidly evolving space.

One of the main challenges in the NFT market is the issue of oversaturation. With an increasing number of NFTs being minted every day, standing out from the crowd can be difficult. This oversaturation can lead to decreased demand for individual NFTs, making it harder for creators to sell their work at a profitable price.

On the other hand, the NFT market also offers unique opportunities for creators to monetize their work in new ways. By tokenizing their art, music, or other digital assets, creators can reach a global audience and potentially earn royalties every time their NFT is sold in the secondary market.

Another challenge in the NFT market is the issue of copyright infringement. With the ease of copying and sharing digital files, ensuring the authenticity and ownership of an NFT can be a challenge. This can lead to legal disputes and undermine the value of NFTs as a whole.

Despite these challenges, the NFT market also presents opportunities for investors to diversify their portfolios and potentially earn significant returns. As the market continues to mature and new use cases for NFTs emerge, there is a growing demand for these digital assets, driving up their value.

Future Trends in NFT Economics

The future trends in NFT economics are constantly evolving as the market continues to mature. One of the key trends that we are seeing is the integration of NFTs into various industries beyond just art and collectibles. This expansion into areas such as gaming, real estate, and even intellectual property rights is opening up new opportunities for creators and investors alike.

Another trend that is emerging is the development of more sophisticated NFTs that offer additional utility beyond just ownership. These utility NFTs can provide access to exclusive content, special events, or even voting rights within a community. This added functionality is increasing the value proposition of NFTs and attracting a wider range of participants to the market.

Additionally, we are seeing a shift towards more sustainable practices within the NFT space. With growing concerns about the environmental impact of blockchain technology, there is a push towards more eco-friendly solutions such as proof-of-stake mechanisms. This focus on sustainability is likely to become a key consideration for both creators and consumers in the future.